Welcome to our world

Your coach to become debt-free

Become master of your financial future

Our Projects

Our project is the process of discovery

We really care. We will help you get to the bottom of the story. You are the one who knows your situation best. We only meet you once you reach out to us…

Our commitment is to let you be the one to conquer the debt.

About Us

We have literally gone through the same process we propose

Our experience taught us to guide others as we believe in the reality that I should not expect others to do stuff I don’t want to do.

Our Work

We help you walk the path from debt to financial freedom

Our Pricing

Our basic info

Basic

Basic Plan

We meet in 3 sessions (about 60 min each) with you and help you find the road ahead

- On-line 1-on-1 meetings

- Discussion basically monthly

- Email support

- Personal growth

- Follow an agreed pathway

R 999 For 3 sessions

Professional

Ultimate Plan

This is a 6 month process – Personal guidance

- Online 1-on-1 monthly meeting

- Discussion Downloads

- Email support

- Access to downloads

- Interactive guidance

- 2 Business day response

R 1799 for 6 sessions

Premium

Premium Plan

This is an annual plan. Steps from Debt to Wealth.

- On-line 1-on1 monthly

- Email Support

- Discussion Community

- Access to downloads

- Interactive guidance

R 3199 for 12 sessions

Our Portfolio

It is all about leaving the Debt Trap and becoming financially free

The average South African is spending 62% or more of his/her income on servicing debt. This is not sustainable. We would like to help people with a simple and easy to follow step by step approach to get out of debt free. We have a YouTube video in which we actually share this process absolutely free as well as several blog posts in which we discuss the process.

Our F.A.Q.

How does it work?

Well the following: We have the opportunity to schedule a free first consultation session with you. during the session we will try to get to know you and you will aso get to know us. We will together determine the way forward. You can make the decision whether we have a match and if you want to start the coaching road with us. We will also be able to get an idea of your expectations etc…

We have however discovered that many people are so overwhelmed by their situation that they need to talk to someone to guide them. We are in the business of exactly that. We halp you discover your answers to your situation on your terms.

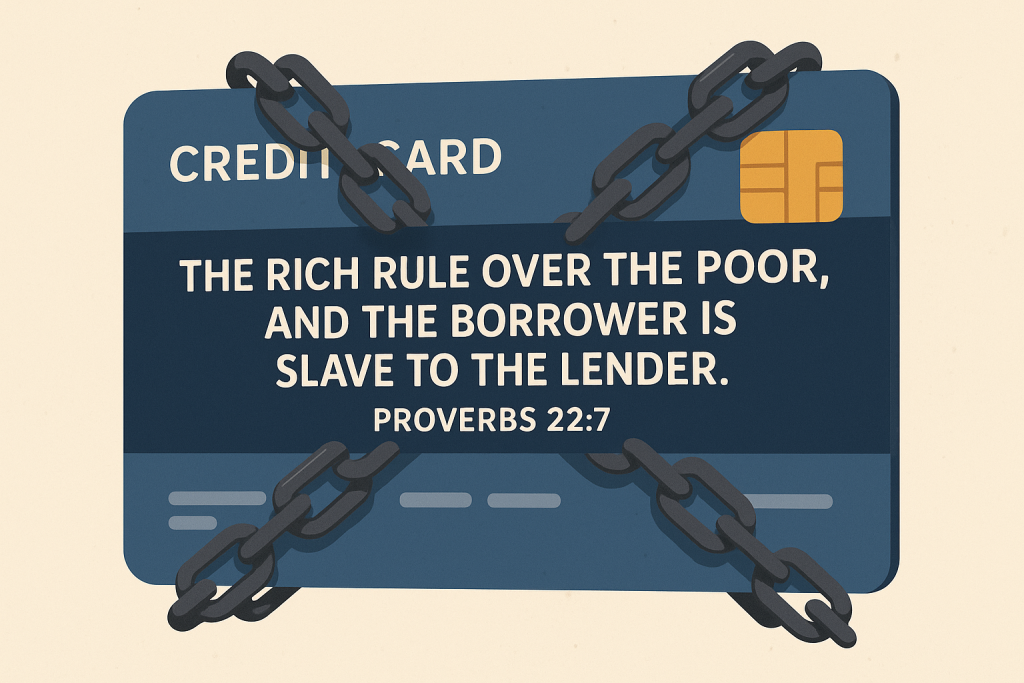

This is a clear no! We might refer you to professionals if that might be required but our approach is to Literally assist you to find your personal plan with a little guidance to get some options on the table. Eventually it is your plan not ours – it is your responsibility not ours. It sounds horrible but let’s face it if we lend you money you are in essence becoming our slave and we don’t want slaves. We actually want to help you become free.

You need to be willing and able to make a lifestyle change. You need to be annoyed enough with your situation as a slave to the people that borrowed you their money that you want to change it.

Then you also need to complete the sheet to get a grip of your personal financial position.

Once that is done you hve the choice to either start the process yourself to follow the baby steps as described or you can set-up a discussion with one of our coaches to help you discover the way forward – It is not about telling you what to do more about helping you discover your own capacity.

Again then it is excecution of your plan as you made.

Please book a free consultation appointment to see if we are a match on this issue.

It does! It worked for more than 10 million people in more than 30 years. In my personal situation it has also brought me out of debt except for my Home Loan. The story of my road will be in a blog post soon.

It is called the 7 baby steps and it was developed by a guy called Dave Ramsey who has grown from a bankrupt 20-something to a nett worth of more than US$300 million by following this steps. (I wish I discovered it earlier in my life.) The main idea is to avoid debt as it is the main reason of bankruptsy in the world. The Bible also teaches us that to be in debt is to be the slave of someone or something. By not having debt and being able to buy cash we are no-ones slave. these steps actually shows us how to grow into the position to be debt-free and be cash strong.

The actual goal of all this is to experience the intended blessing and be a blessing to others. To experience the freedom to choose to live your life and to give to your favourite charity or church.

This might be the biggest issue in the world today. A very subjective piece of “research” that used the information about people who were in debt to determine if they should be able to repay their debt based on probability. Now let me ask you with tears i my eyes if I were a billionaire and I needed to rent an apartment in a particular area for a period of time but I don’t have a credit score what would be the probability of me not paying my rent?

My money in the bank would not change my credit score – yet I am more than capable to pay the rent above – but if i buy a very expensive piece of clothing at an apartment store where I struggle to make the monthly payments but do, I will get a good credit score. And will virtually be securing the rental agreement while I might not be able to pay the rent?

This credit bureau story is perhaps justified by debt and people not paying the debt as they should – but it is probably what one can call trickary to get people to engage in debt.

As you can see on our pricing schedule there is an advantage to pay up front however we do also offe a monthly option. Payment is due before every session – and we need the funds to reflect on our account 24 hours before the session is scheduled to start.

Contact Us

Lorem ipsum dolor sit amet, consectetuer adipiscing elit. Neque porro quisquam est, qui dolorem ipsum quia dolor sit amet, consectetur

- Die Wilgers Pretoria South Africa

- +27 (0)87 550 9258

- support@financialfreedom.org.za

Financial freedom is all about being able to decide what to do with your money and not have it tied up in a long list of obligations.